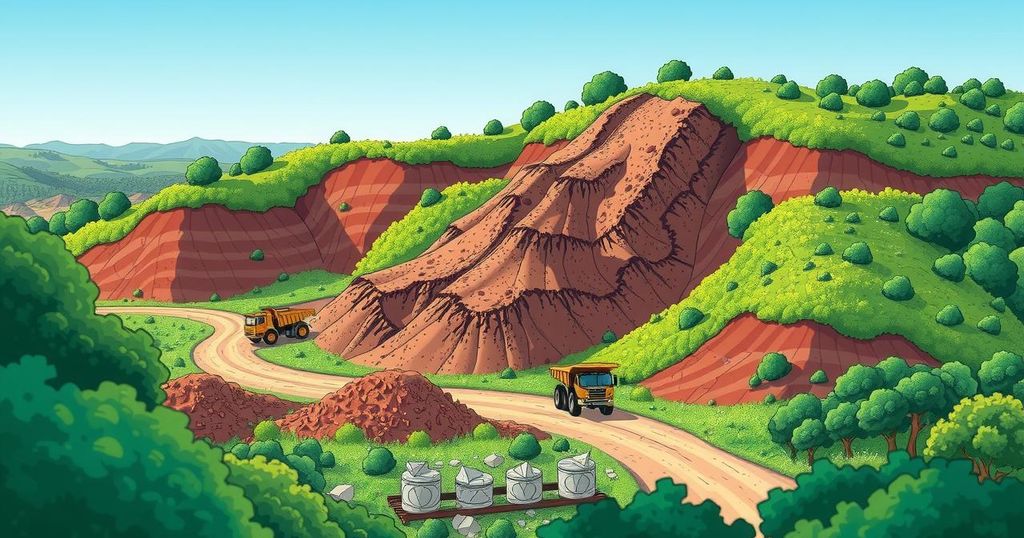

Nativo Resources has formed an option agreement with Boku Resources SAC to explore gold and silver recovery from the Toma La Mano tailings deposit in Peru. The project aims to address environmental concerns associated with historic mining, utilizing a low-carbon and efficient strategy for precious metal extraction. A feasibility study and resource estimation are to be conducted over three years.

Nativo Resources has announced the signing of an option agreement with its joint venture partner, Boku Resources SAC, to assess the opportunity for recovering gold and silver from the Toma La Mano tailings deposit in Peru. This project is situated in the Ancash region, and the tailings are owned by Corporación Minera Toma la Mano, which operates a polymetallic tolling plant processing various metals.

The tailings deposit consists of approximately 1.8 million tonnes of polymetallic material, derived from historic mining activities. Historical data presents gold grades ranging from 0.1 to 1.7 grams per tonne, along with silver grades between 10 and 37 grams per tonne, although uncertainties exist regarding residual grades and recoveries.

Under the new agreement, Boku will have three years to perform a resource estimation and feasibility study, entailing metallurgical analysis to establish recovery rates and optimize processing methods. Should the evaluations indicate viability, Boku can set up a processing facility to extract the precious metals, agreeing to rent the tailings at a rate of $3 per tonne processed, along with a 6.5% royalty fee on revenues—which increases to 7% after covering 30% of expenditures.

Nativo’s board mentions that this initiative is in line with goals to reduce the environmental impact of historical tailings, addressing water and soil contamination while minimizing land degradation. The effort to re-mine these tailings is presented as a lower-carbon alternative to traditional mining practices, as it utilizes less energy and generates fewer greenhouse gas emissions.

CEO Stephen Birrell described the agreement as the initial step in a series of similar tailings remediation projects identified in the region. He emphasized the simplicity of processing tailings dumps, which pose environmental liabilities, underlining Boku’s strategy to use advanced technology for cleanup, resource extraction, and subsequent land remediation.

Birrell further stated that this represents a low-cost and low-risk business model, allowing for effective resource definition with minimal capital and operational expenditures. He noted the scalability of this model, given the presence of tailings deposits throughout Peru that require cleaning solutions. With favorable gold prices, Birrell expressed optimism about this model benefiting all parties involved and indicated a target for a final investment decision by the first quarter of 2026.

In conclusion, Nativo Resources has initiated a substantial agreement with Boku Resources SAC for the evaluation of gold and silver recovery from the Toma La Mano tailings deposit in Peru. The project aligns with environmental remediation efforts while also presenting a low-risk, low-cost mining strategy. The potential benefits offered by this model to stakeholders, paired with promising financial conditions, underscore the project’s significance in the mining sector.

Original Source: www.sharecast.com