Ghana’s Treasury bill rates have dropped below 20% for the first time in 20 months, reflecting enhanced investor confidence and a shift in government borrowing strategies. The latest auction shows significant reductions in rates and total bids accepted, signaling a move towards fiscal consolidation. Lower rates are expected to benefit businesses, reduce government debt servicing, and encourage private investments, although sustained stability and inflation control are crucial.

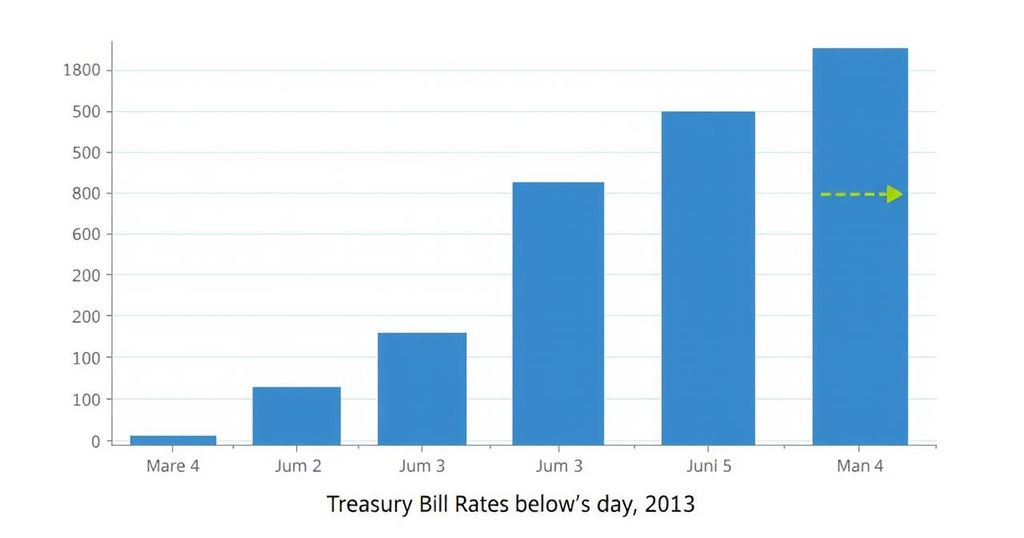

In a notable development, Ghana’s Treasury bill (T-bill) rates have fallen below 20% for the first time in 20 months, indicating a change in the government’s borrowing strategy and an increase in investor confidence regarding the nation’s economic recovery. Recent auction results released by the Bank of Ghana show that the 91-day T-bill rate has dropped to 17.72%, the 182-day bill to 18.97%, and the 364-day bill to 19.98%. These rates mark a significant decline from the previous week’s figures of 20.79%, 22.99%, and 22.69%, respectively.

The reduction in T-bill rates reflects a decreased reliance on short-term domestic borrowing, which aligns with the government’s shift toward fiscal consolidation and the exploration of alternative funding sources. In January 2025, the government successfully raised GH¢38.45 billion through T-bills, slightly below the GH¢40.57 billion that investors offered. Authorities have been denying bids aggressively to lower yields, aiming to reduce borrowing costs.

Additionally, the total bids accepted in the latest auction fell to GH¢6.22 billion from GH¢7.41 billion on February 28, illustrating a move to restrict excessive domestic borrowing. President John Dramani Mahama acknowledged the declining rates during his State of the Nation Address, attributing this trend to increasing investor confidence in the government’s fiscal discipline.

The consistent decrease in interest rates is anticipated to lower borrowing costs for businesses and individuals, thus enhancing access to credit. Furthermore, it aims to alleviate the government’s debt servicing burden, allowing for more resources to be allocated towards development projects. Encouraging shifts in investments from risk-free government securities to more productive private sector ventures is also expected. However, analysts warn that while the drop in T-bill rates is promising, long-term economic stability and inflation control remain essential for sustained benefits.

In conclusion, Ghana’s falling Treasury bill rates below 20% signify a notable shift in governmental borrowing strategies and heightened investor confidence in economic management. These trends are likely to lead to reduced borrowing costs, less debt servicing for the government, and increased opportunities for private sector growth. While these developments are positive, analysts emphasize the need for ongoing economic stability and effective inflation control to ensure lasting success.

Original Source: www.graphic.com.gh